Lot Size Guide For FXCM Based on ESMA 2018 New Margin Requirements

*This Tutorial is for educational purposes only. It is an explainer article for the recent changes in the European Securities and Markets Authority (ESMA) on changes made last August 1, 2018.*

Lot Size Guide Based on FXCM UK Margin Requirements

If you are using FXCM UK, as of July 29, 2018 they have increased their margin requirements per 1K lot due to new ESMA Policies.

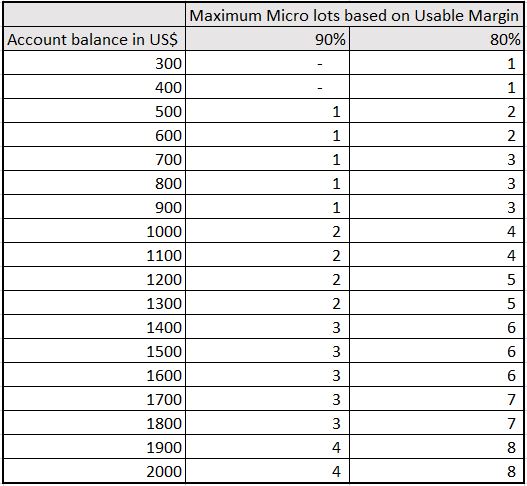

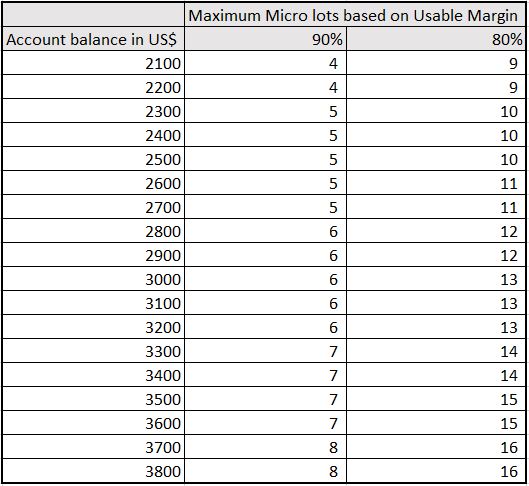

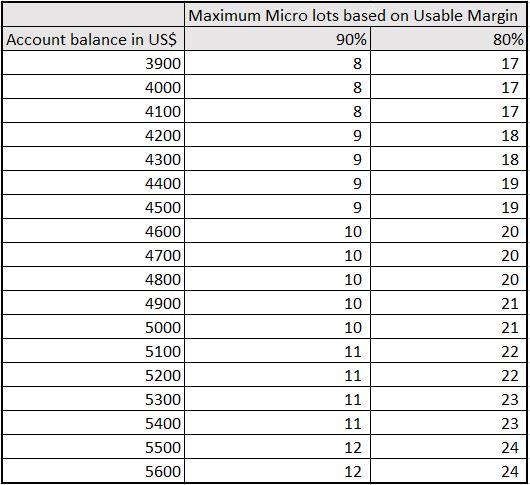

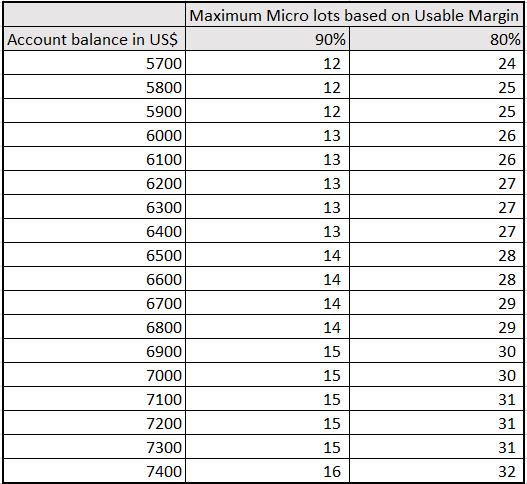

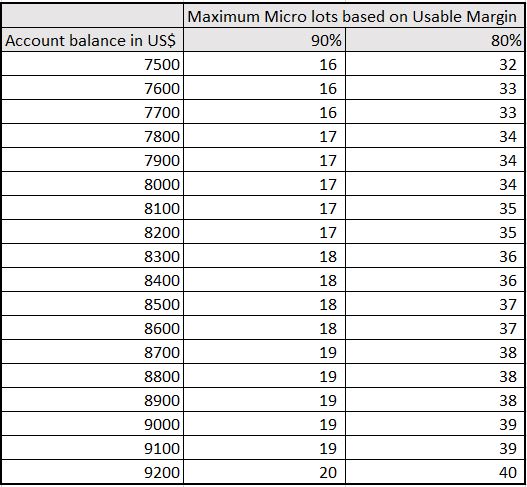

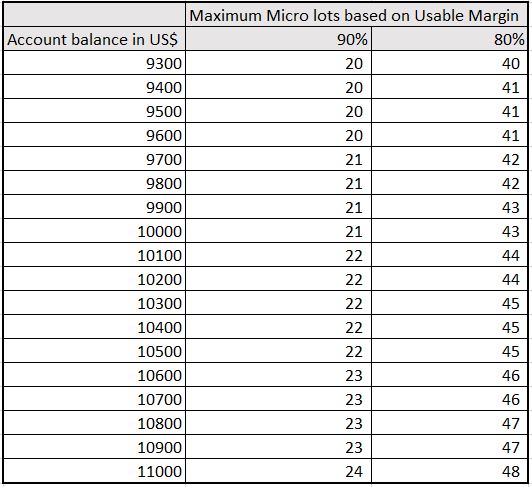

To help out all members, please see the revised Lot Size Guide based on how much balance you have in your account.

Please note that with the new Margin requirements, your lot sizes will be reduced significantly from 1:100 to roughly 1:30. To compensate, you will have to reduce your aggressiveness and/or increase your account balances accordingly

How to use this guide

Only follow the lots recommended based on your risk appetite, 90% Usable Margin or 80% Usable Margin

For example, if your balance is 11,000 and you are you are more of a risk taker, look at the 80% Column you can trade up to only 48 Micro Lots total or 20% of your account balance.

What should I follow, the Software recommendation or this Lot Size Guide?

You must follow both. So please read this carefully and diligently. Here is what you need to do moving forward:

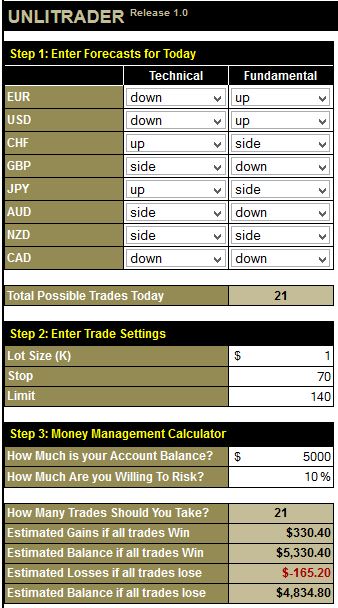

The software recommends 21 currency pairs to trade.

The software recommends 21 currency pairs to trade.

Your balance is $5,000 (look at step 3 in the screenshot on the left) and you are willing to risk 10%. The calculator recommends taking 21 trades.

Look at the lot size guide and find your balance of $5,000 then pair it with either the 90% or 80% Column. The 90% guide says 10. The 80% guide says 21

So, only trade with either 10 or 21.

Please remember, in this new environment, we now need to pay closer attention to the Margin requirements aside from stop losses in order to safeguard our funds.

Remember, do not exceed the recommended lot size recommendations based on this guide because doing so increases the possibility of margin calls and we do not want that.

Aside from this change and additional filtering, everything will be as it was before, i.e. Please continue to follow the recommended Stops and Limits that I continue to provide, follow the recommended times to enter and exit every time I trade.

For any questions or concerns you may have, please post a comment below and I will answer you within 48 hours or less.

Monsterpips to All!

-Mark

Risk Warning: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading, and seek advice from an independent financial advisor if you have any doubts.